Proof of Photo ID and address as per KYC Norms

#AUTO SWEEP BANK ACCOUNT REGISTRATION#

Ø Identity proof, Address proof, Photos, Memorandum and Articles of Association, Certificate of Commencement of Business, Partnership Deed, (wherever required) Certificate of Incorporation and Board Resolution, Registration Certificate (in the case of a registered concern), Certificate / Licence issued by the Municipal Authorities under Shop & Establishment Act etc. Ø Application in the Banks’ prescribed form. Maximum remittance Rs 50 lakhs per month. (Facility available at home branch and denomination of Rs 100/= and above only) An automatic sweep is a programmed order to execute standing instructions that move funds from one account to another. 5 lakhs (Facility available in corporate accounts only) The exceeding amount in the multiple of Rs. It can be carried out as per customers’ request for balance beyond Rs. The account holders, throughout the quarter, will have to maintain a minimum balance of Rs. In other Bank ATMs, limit as permissible for other Banks’ card holders.Īuto sweep facility available. Personal Accident Insurance available up to Rs.2.00 lakhs to Rs.8.00 lakhs for self/spouse as inbuilt facility under Platinum Debit Card Premier segment customers maintaining quarterly average balance of Rs 1 lakh & above Sustainable Development and Corporate Social Responsibility (SD-CSR)ĬANARA PRIVILEGE CURRENT ACCOUNT – CATERING NEEDS OF PREMIER SEGMENT OF CUSTOMERS MAINTAINING QUARTERLY AVERGAE BALANCE OF 1 LAKH & ABOVE.

#AUTO SWEEP BANK ACCOUNT DOWNLOAD#

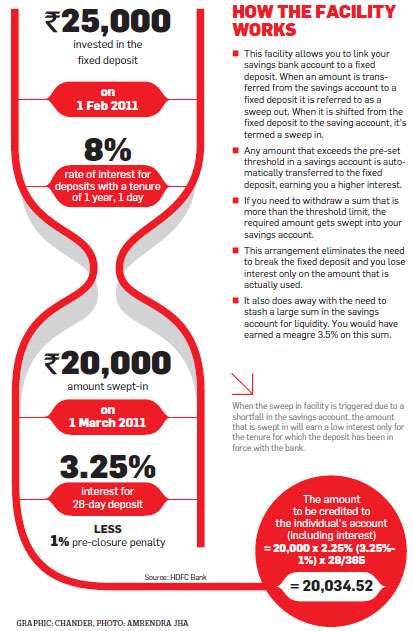

Download TDS Certificate for payment of Dividend FY 2021-22.Appeal to Physical Shareholders of Canara Bank.ONLINE SUBMISSION OF 15G/15H APPLICATION.The LIFO (Last in First Out) rule is typically used by banks in these situations, which implies that when a sweep-in is triggered, money will be moved to your account from the most recent deposit associated with the sweep-in facility.

To ensure you never experience a liquidity crisis, you can link numerous deposits to the current account for sweep-in. Download Glossary Sweep Account Related Content Glossary Sweep Account A bank account set up to operate so that at the end of each banking day all or a portion of the funds on deposit in the account are automatically transferred ('swept') into another account. Initial deposit for opening the account and maintenance of minimum balance - The account. Step 3: In the Deposit section, you can see the Auto-Sweep Facility (Grow your Money) option, click on this option. Title of the Scheme - No-frills Savings Bank Account (Zero Balance). To ensure prompt payment of the EMI or the check, your bank will immediately transfer the funds from the earlier invested amount to your account, saving you time and effort. Step 1: Login to SBI internet banking ( Step 2: After login, click on Deposit & Investment and open the Deposit section as you can see in the below screenshot. Imagine that your sweep current account is getting short on cash and that you have an EMI or a check that is coming due. You can have a lot of liquidity thanks to the sweep facility, which also guarantees a fair return on your investment. Opting sweep in the facility doesn't require you to hold for a required term. Personal Smart Saver Term Deposit Scheme (SDD) FEATURES & BENEFITS Core Term Deposit Amount: Rs 25,000/- and above in multiples of Rs 1000/- as core deposit. However, there can be a required minimum holding term for FDs, and early withdrawal could result in interest loss. Customers of Chase’s online banking services have seen double transactions, fees and payments in their accounts. In most cases, banks allow you to pick the deposit's duration, maturity, and threshold amount. You may also utilise an FD interest calculator to gain a better picture of your anticipated returns. The primary benefit of choosing the sweep service is the opportunity to earn interest on the funds in your account. The facility is available for everyone whether you are a business owner, a salaried person or just a saving account holder. This is done every Monday morning at 9 am IST. 50,000/- (the threshold limit), then an amount equal to 10 of the excess will be transferred from your Savings Account into your Short Term Deposit Account. There are many advantages to opting for the auto sweep facility. By opting into the Auto-Sweep Account, FSM automatically transfers and sweeps all your excess cash such as sales proceeds, bond maturities, dividends, coupons. Auto Sweep: Under this facility, if the balance in your account exceeds Rs. Why you should opt for Auto Sweep Facility?

0 kommentar(er)

0 kommentar(er)